China’s EU trade wrangling has Australian winemakers, exporters eyeing new opportunities

- Speculation over possibility of Beijing imposing tariffs on European wine seen as an opening for Australian industry in China after three-year dry spell

A potential tit-for-tat trade spat between China and the European Union could be Australian winemakers’ gain at the expense of EU wineries’ pain – a scenario that industry players from both sides are bracing for.

France was the largest wine exporter to China last year with a total value of US$559.73 million, according to figures from Statista, while Italy and Spain were the third- and fourth-largest exporters with total values of US$117.22 million and US$66.99 million, respectively.

“Import tariffs on EU wines could create an opening for Australian wine in China [due to] reduced competition [with] higher prices,” said Jeson Chen, a wine exporter from Melbourne for 13 years.

But Chen had his doubts about “a full comeback” in the near term, owing to the fact that it takes time for Australian wineries to rebuild their “lost market share”, and as competition from other wine regions may also fill the gap left by the EU products.

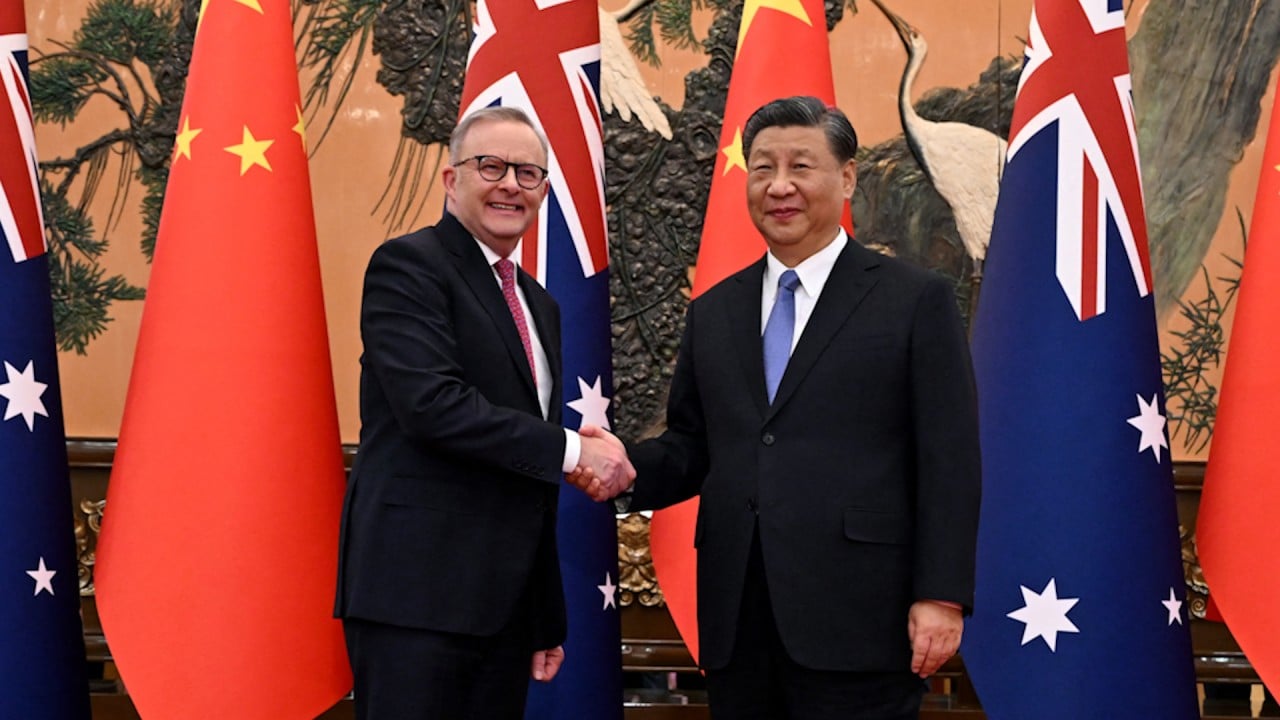

The import tariff on Australian wine of up to 218.4 per cent was lifted from March 29 amid warming relations between the countries, and Australia also discontinued its legal proceedings at the World Trade Organization regarding the trade sanction.

As a result, Chinese customs data showed that China imported US$10.4 million worth of wine from Australia in April, up from a mere US$126,045 a year earlier, representing a roughly eightyfold increase after import tariffs were removed for the first time in three years.

By comparison, before its potential import levy toward EU’s goods, Beijing has already imposed import tariffs as high as 48.2 per cent on wine from France since 2013 and opened an anti-dumping investigation into brandy imported from the EU in January this year.

China had been the largest market for Australian wine before 2020, with its total export value reaching A$1.1 billion (US$725 million) in 2019.

Andrew Calliard, a wine industry consultant in Sydney, said that “there will be a bounce back of trade” for Australian wineries, but most producers “will be careful” with their allocations to mitigate against the possibility of tariffs being imposed again.

He believes that it is “difficult to know how far [the comeback] will go”, given that the success of Australian wineries to crack the Chinese market will be “patchy” and dependent on how wineries engage with potential partners.

Meanwhile, Laurent Dufouleur, head of France’s Tramier Collection vineyard, said on the sidelines of Vinexpo that the latest development about Beijing possibly imposing tariffs on French wines “could happen”, describing it a “pure politics game”.

“We have to cope with any economic war in the future,” he noted. “We will not be happy, but we will survive from that.”

Luc Delaunay, sales manager at French wine merchant Domaine Maby, also said on the sidelines of Vinexpo that the company is working on a “de-risking” strategy by shifting more focus to the domestic French market, with only half of the firm’s products being sold overseas.

Beyond tariffs, analysts caution that weak demand from the Chinese market poses another challenge for overseas winemakers.

Shirley Zhu, research director for Greater China at alcohol data and intelligence company IWSR, said that consumers were looking for more value for their money amid the current economic landscape, and that wine has been facing increasing competition from beer and baijiu spirits.

“Importers and wholesalers are more cautious with where they put their money, to create better cash flow,” she added.